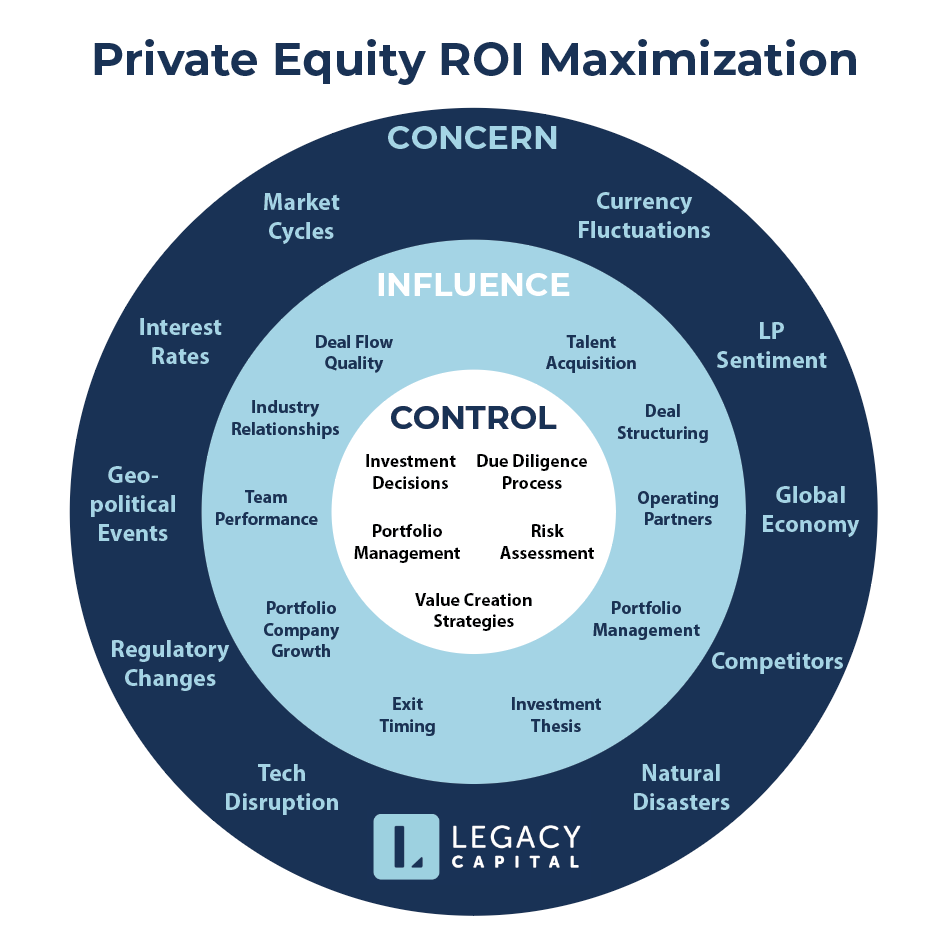

This article details key Legacy Capital Fund areas of focus, concern, influence, and control for PE investments in 2025.

As an investor, you have three key areas to consider in your “Private Equity Circle Of Control”. In order to make the best investment decisions, you need to have a handle on all three, so let’s jump right into our predictions for 2025 based on research from across various global sources, publications, and experts.

Based on the industry list shown in the image, here are the sectors with their projected 2025 growth/ROI metrics:

High Growth Sectors (>20% CAGR)

Deep Tech, AI/ML, Robotics, Quantum Computing

- 37.3% CAGR through 2025

- Market size: $407 billion by 2025

Cybersecurity

- 23.8% CAGR

- Market size: $248.6 billion by 2025

Fintech, Payments, InsureTech

- 23.58% CAGR

- Market value: $324 billion by 2025

Moderate Growth Sectors (10-20% CAGR)

Life Sciences, Healthcare & MedTech

- 15.1% CAGR

- Market size: $550.73 billion by 2025

Clean Energy, AgTech, Renewables, Utilities

- 12.1% CAGR

- Investment volume: $1.3 trillion by 2025

Data & Analytics

- 13.2% CAGR

- Market size: $346 billion by 2025

EdTech/Online Learning

- 16.3% CAGR

- Market size: $342.4 billion by 2025

Stable Growth Sectors (5-10% CAGR)

Advanced Materials, Structures, & Manufacturing

- 8.6% CAGR

- Market size: $294.5 billion by 2025

Aerospace, Aviation, & Defense

- 7.2% CAGR

- Market size: $573 billion by 2025

Enterprise Software

- 9.3% CAGR

- Market size: $382 billion by 2025

Logistics, Mobility, Transportation, Supply Chain

- 8.7% CAGR

- Market size: $12.8 trillion by 2025

Emerging Sectors (Variable Growth)

AR & VR

- 18.7% CAGR

- Market size: $97.7 billion by 2025

Blockchain

- 68.4% CAGR

- Market size: $39.7 billion by 2025

Cannabis

- 14.9% CAGR

- Market size: $38.2 billion by 2025

Traditional Sectors (3-7% CAGR)

Beauty

- 4.8% CAGR

- Market size: $716.6 billion by 2025

Consumer Products, Goods, & Services

- 4.2% CAGR

- Market size: $14.9 trillion by 2025

Fashion, Retail, Merchandising Tech

- 6.7% CAGR

- Market size: $3.3 trillion by 2025

Food & Beverage/Food Tech

- 6.2% CAGR

- Market size: $9.1 trillion by 2025

Health & Fitness

- 7.8% CAGR

- Market size: $96.6 billion by 2025

Hospitality, Tourism, Travel

- 5.9% CAGR

- Market size: $8.9 trillion by 2025

HR Tech/Workforce

- 5.7% CAGR

- Market size: $38.2 billion by 2025

IT Hardware/Industrial Tech

- 4.5% CAGR

- Market size: $2.3 trillion by 2025

Media/Communications

- 5.4% CAGR

- Market size: $2.8 trillion by 2025

Real Estate/PropTech

- 4.8% CAGR

- Market size: $3.8 trillion by 2025

Note: These projections are based on various industry reports and market analyses. Due to the dynamic nature of markets and external factors, actual growth rates may vary. See our disclaimer below.

Performance and Returns

Recent trends in PE performance show a divergence between buyout and venture capital funds. Buyout funds have demonstrated positive returns, while venture capital has faced some challenges. This suggests that investors may want to allocate more of their PE portfolio to buyout funds in 2025.

There’s also been a noticeable shift in value creation strategies. With changing market conditions, PE firms are increasingly focusing on driving revenue growth and margin expansion.

Industry Trends and Market Dynamics

Staying abreast of industry trends is crucial for identifying the most promising PE opportunities in 2025:

Sector Focus: Pay attention to sectors showing strong growth potential and resilience in the face of economic uncertainties. Healthcare, technology, and renewable energy are sectors that have shown particular promise.

Deal Activity: Analyze deal activity across regions and sectors to identify areas where PE firms are finding the most attractive opportunities. This can provide valuable insights into where the market is heading.

Fundraising Trends: Understanding which types of funds are attracting capital can help you align your investment strategy with broader market movements. Large, established funds and those with specialized sector expertise have been particularly successful in recent fundraising rounds.

Emerging Markets and Alternative Strategies

Don’t overlook opportunities beyond traditional PE investments:

Emerging Markets: Growth opportunities in emerging markets, particularly in Asia and Latin America, are attracting increased attention from PE firms. While these investments may carry additional risk, they also offer the potential for higher returns.

Impact Investing: There’s a growing interest in impact investing within PE. Funds that successfully balance financial returns with positive social or environmental impact may be well-positioned for 2025.

Venture Capital in Africa: The African startup ecosystem is presenting exciting opportunities for PE investors. Consider allocating a portion of your PE portfolio to this high-growth region.

Wrap Up

To maximize returns from PE funds in 2025, investors should:

- Focus on buyout funds with strong operational efficiency and digital transformation strategies

- Consider ESG-focused funds as they gain prominence

- Stay informed about sector-specific trends and deal activity

- Explore opportunities in emerging markets and impact investing

By leveraging these insights and staying attuned to market dynamics, investors can position themselves for strong returns in the evolving landscape of private equity. Remember, the PE market is complex and ever-changing, so continuous learning and adaptation are key to success in this space.

Book your meeting with Legacy Capital Fund’s GP Scott Hauck or Chief Investment Officer Heidi Diemer today to learn more about investing in Legacy Capital Fund.