The healthcare industry continues to evolve with rapid technological advancements, and private equity firms are increasingly recognizing the potential of investing in healthcare IT through Registered Investment Advisors (RIAs).

The Healthcare IT Revolution

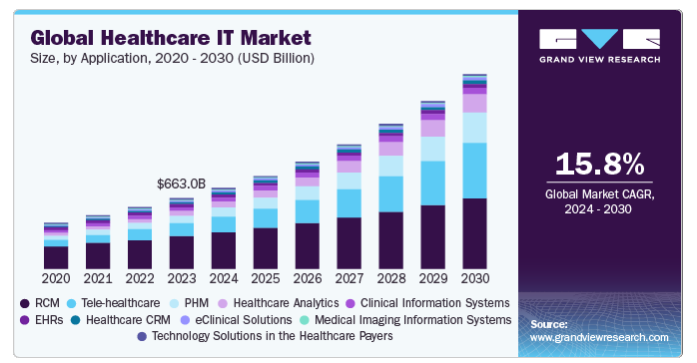

Healthcare IT encompasses a wide range of technologies designed to enhance healthcare delivery, patient outcomes, and operational efficiency. The sector’s growth is fueled by technological advancements, changing demographics, and evolving consumer expectations. Private equity firms are capitalizing on these trends by investing in RIAs that focus on healthcare IT opportunities.

SOURCE: Grand View Research

Key Trends in Healthcare IT

- Telemedicine and Remote Monitoring:

The COVID-19 pandemic accelerated the adoption of telemedicine and remote monitoring technologies, creating new investment opportunities. Private equity firms are backing RIAs that invest in companies providing innovative solutions for virtual care and patient engagement. - Data Analytics and AI:

The integration of data analytics and artificial intelligence in healthcare IT is transforming how healthcare providers analyze patient data, predict outcomes, and personalize care. Private equity investments are supporting RIAs that leverage AI to enhance clinical decision-making and operational efficiency. - Scalable Healthcare Solutions:

The demand for scalable healthcare IT solutions is growing, with private equity firms investing in RIAs that focus on scalable technologies to address critical healthcare challenges and improve patient care.

Success Stories: Private Equity and RIA Collaborations

Private equity firms have successfully partnered with RIAs to invest in scalable healthcare IT technologies, achieving both financial and social returns. Notable success stories include:

- Earned Wealth:

A tech-centered financial services firm focused on medical professionals, Earned Wealth in July of 2024 received a $200 million private equity investment to expand its platform and offerings. This investment highlights the potential of tech-enabled financial management solutions tailored for healthcare professionals. - RIA Advisory’s Healthcare Solutions:

By leveraging private equity investments, RIA Advisory has developed robust solutions for healthcare revenue management, including pharmacy benefit management and provider revenue management, showcasing the impact of strategic investments in healthcare IT.

Private Equity’s Role in Healthcare IT

Private equity firms have been instrumental in driving innovation and growth in healthcare technology through strategic investments in RIAs. The focus has been on scalable solutions that enhance healthcare delivery and patient outcomes. Key Reasons:

- Transaction Volume:

The RIA industry saw 225 transactions in 2022, setting a new record despite a 19.4% decline in the S&P 500 and a 15.3% decline in a moderate portfolio index. - Market Dynamics:

The median-adjusted EBITDA multiple increased by 11.1% from 2021 to 2022, marking the fifth consecutive year of growth, although the rate of increase slowed due to rising costs of capital. - Valuation Trends:

The median-adjusted EBITDA multiple increased by 11.1% from 2021 to 2022, marking the fifth consecutive year of growth, although the rate of increase slowed. - M&A Market Trends:

In 2022, the RIA M&A market experienced significant changes, driven by a post-pandemic inflationary cycle and historic interest rate increases. Despite these challenges, the market set new records in volume and valuation multiples, although total valuations fell due to market-driven asset value declines. - Private Equity’s Role:

Private equity firms have been actively investing in RIAs, driving innovation and growth in sectors like healthcare technology. The report notes that private equity-backed RIAs are growing through acquisitions, leveraging capital to expand their offerings and enhance service delivery. - Healthcare Technology Investments:

RIA aligned Private equity investments in healthcare IT are focusing on acquiring and growing scalable solutions that enhance healthcare delivery and patient outcomes, aligning with broader industry trends towards digital transformation and technological advancement. - Adaptation to Market Conditions:

Private equity firms are modifying deal structures to align with rapidly changing market conditions. This includes a shift towards long-term consideration methods such as equity and earnouts, reflecting a more collaborative approach between buyers and sellers.

Strategic Insights for Private Equity Firms

Private equity firms looking to invest in healthcare IT through RIAs should consider the following strategies:

- Focus on Impact Investing:

Align financial goals with the desire to make a positive healthcare impact by investing in companies and projects that address healthcare and social challenges while improving access to care. (Legacy Capital Fund supports mental health technology initiatives, for instance). - Leverage Expertise and Networks:

Utilize specialized knowledge and networks in healthcare to identify high-potential investment opportunities and provide valuable insights to portfolio companies. - Emphasize Scalability:

Investing in scalable healthcare IT solutions allows private equity firms to achieve significant returns while addressing pressing healthcare needs.

Wrap Up

The intersection of RIAs, private equity, and healthcare technology presents a compelling opportunity for growth and innovation. As the market continues to evolve, strategic investments in scalable healthcare IT solutions will be key to driving success. With a strong foundation in place, the future of RIA and private equity investments in healthcare technology looks promising, offering significant potential for both financial and social returns.

Citations:

- [1] RIA Deal Room 2023