In the ever-evolving landscape of healthcare technology, multi-strategy funds and private equity firms are pivotal in driving innovation and scalability. These investors are strategically navigating the complexities of the sector, capitalizing on its potential for growth and transformation.

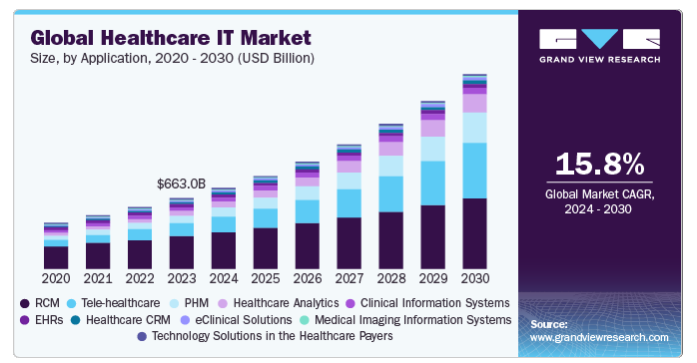

SOURCE: Grand View Research

Key Trends in Healthcare Technology Investments

- Increased Focus on Digital Health:

The digital health sector has seen a significant surge in investment, with nearly $30 billion invested into 738 deals in 2021 alone. This trend is driven by the growing demand for telehealth, remote monitoring, and digital therapeutics, which have become essential in the wake of the COVID-19 pandemic. - Shift Towards Mid-Tier HealthTech Companies:

Private equity firms are increasingly targeting mid-tier healthtech companies that have demonstrated proof of concept and consistent profitability. These companies offer lower risk and potential for double-digit growth, making them attractive targets for strategic rollup strategies. - Emphasis on AI and Machine Learning:

AI and machine learning technologies are at the forefront of healthcare tech investments, enabling enhanced diagnostics, personalized treatment plans, and improved patient outcomes. These technologies have received the most funding in recent years, reflecting their transformative potential in healthcare. - Consolidation in Health IT and Medtech:

The health IT and medtech sectors are experiencing consolidation, driven by private equity firms seeking to create larger, more efficient platforms. This trend is evident in the high volume of add-on acquisitions and growth investments in these subsectors. - Focus on Behavioral Health and Digital Therapeutics:

The behavioral health sector is ripe for consolidation, with private equity firms investing in digital mental health platforms and teletherapy services. These investments aim to expand access to care and improve patient engagement and outcomes. - Digital Health Expansion:

The digital health sector has seen a significant surge in investments, with $5.1 billion invested across 347 deals in Q1 2024 alone. This growth is largely driven by the increasing demand for telehealth, remote monitoring, and digital therapeutics, which have become essential in the post-pandemic landscape. - AI and Machine Learning Integration:

AI and machine learning are at the forefront of healthcare technology investments, enabling enhanced diagnostics, personalized treatment plans, and improved patient outcomes. These technologies have received substantial funding, reflecting their transformative potential in healthcare. - Platform Providers as Key Players:

The rise of platform providers—entities that create and maintain the basis for data exchange, analytics, and user engagement—is a key trend. These companies are becoming attractive targets for private equity firms due to their potential to become standard-setters in the healthcare value chain. - Surgical Robotics and Wearables:

The integration of surgical robots and wearables into healthcare is gaining momentum. These technologies are expected to revolutionize patient care by improving surgical precision and enabling continuous health monitoring. - Sustainability and Data Privacy:

As consumers demand more sustainable healthcare solutions, companies are incorporating decarbonization into their strategies. Additionally, data privacy and equity are becoming critical considerations as AI takes on a larger role in healthcare.

Strategic Insights for Multi-Strategy Funds

- Invest in Scalable Web-Based Solutions: Multi-strategy funds should prioritize investments in scalable web-based healthcare technologies that can address widespread healthcare challenges, such as chronic disease management and mental health care. These solutions offer significant returns while meeting pressing healthcare needs.

- Capitalize on Digital Health Consolidation: The digital health sector is experiencing consolidation, with M&A being the predominant exit route. Multi-strategy funds can capitalize on this trend by investing in companies that are well-positioned for acquisition or merger.

- Leverage AI-Driven Innovations: AI-driven healthcare solutions are becoming synonymous with innovation in the sector. Funds should focus on companies that leverage AI to enhance clinical decision-making and operational efficiency, as these technologies are poised for significant growth.

- Prioritize Investments in Platform Providers: Investing in platform providers can yield disproportionate benefits, as these companies are integral to the healthcare value chain. Multi-strategy funds should identify companies that can become standard-setters and provide analytics services for the data they gather.

- Emphasize Ethical and Socially Impactful Practices: Ensuring that investments align with ethical standards, particularly in data privacy and patient consent, is crucial. This focus helps mitigate risks associated with regulatory compliance and enhances long-term value. Also, helping communities is always just great for more than just monetary returns.

Wrap Up

Multi-strategy funds and private equity firms are instrumental in shaping the future of healthcare technology. By focusing on scalable web-based solutions, leveraging digital health consolidation, and investing in AI-driven innovations, these investors are well-positioned to capitalize on the sector’s growth potential.