Family offices are increasingly recognizing the potential of investing in healthcare IT through private equity. These private investment arms of affluent families are leveraging their capital and expertise to drive innovation and growth in digital health.

The Healthcare IT Boom

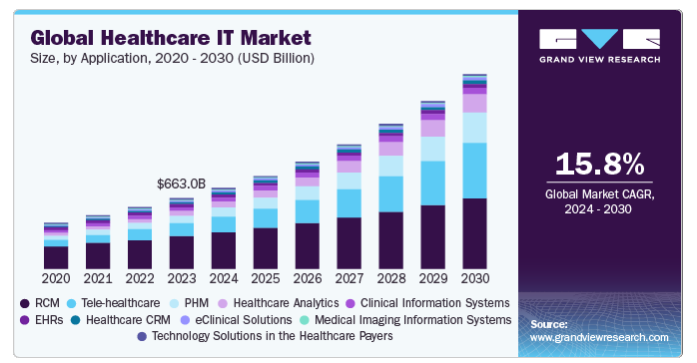

Healthcare IT encompasses a wide range of technologies designed to improve healthcare delivery, patient outcomes, and operational efficiency. The sector has seen significant growth, driven by technological advancements, changing demographics, and evolving consumer expectations. Family offices are capitalizing on these trends by investing in private equity opportunities within the healthcare IT space.

“Our focus is on areas of growth for private equity investors, especially in remotely managed businesses,” says Scott Hauck, Founder and General Partner of Legacy Capital Fund.” Right now there are multiple opportunities to help scale American legacy businesses well positioned in the healthcare technology space.”

SOURCE: Grand View Research

Key Trends in Healthcare IT

- Telemedicine and Remote Monitoring:

The COVID-19 pandemic accelerated the adoption of telemedicine and remote monitoring technologies, creating new opportunities for investment. Family offices are investing in companies that provide innovative solutions for virtual care and patient engagement. - Data Analytics and AI:

The integration of data analytics and artificial intelligence in healthcare IT is transforming how healthcare providers analyze patient data, predict outcomes, and personalize care. Family offices are backing startups that leverage AI to enhance clinical decision-making and operational efficiency. - Mental Health Technologies:

The growing demand for mental health services has led to increased investment in digital mental health platforms. Family offices are supporting companies that offer scalable solutions for mental health assessment, treatment, and support.

Success Stories: Family Offices Reaping Rewards from Scalable Health IT Investments

Family offices have successfully invested in scalable healthcare IT technologies, achieving both financial and social returns. Notable success stories include:

- 4Point0 by Nihar Parikh

4Point0, a family office based in Mumbai, India, has made significant investments in health-tech startups, including a $12 million investment in Fitterfly, a digital therapy platform for weight loss and diabetes management. This investment highlights the potential of scalable web technologies in addressing critical health issues and delivering measurable outcomes. - Interplay Family Office

Interplay Family Office, based in New York, has invested in various healthcare IT companies, including a $50 million series B funding round for Ophelia, a company specializing in online opioid addiction treatment. This investment demonstrates the growing interest in mental health technologies and the potential for scalable solutions to revolutionize healthcare delivery. - Dolby Family Ventures

Dolby Family Ventures, headquartered in San Francisco, has shown a keen interest in healthcare technology, making early-round investments in companies like Paradromics and Genemod. Paradromics is developing a direct data interface with the brain to aid patients with severe paralysis, while Genemod offers a cloud-based platform for life sciences research management. - Duquesne Family Office

The Duquesne Family Office, led by Stanley Druckenmiller, has invested in PROCEPT BioRobotics and Ratio Therapeutics. PROCEPT BioRobotics focuses on autonomous surgical robots, while Ratio Therapeutics develops targeted radiotherapeutics for cancer treatment. - Cox Enterprises

Cox Enterprises has made strategic investments in healthcare IT, including a $14 million Series A funding round for Motivo Health, which provides remote clinical supervision for therapists. This investment aims to address mental health crises by enabling accessible and affordable care.

(SOURCE: FINTRX)

The Role of Family Offices in Advancing Mental Health Technologies

Family offices are uniquely positioned to drive innovation in mental health technologies through private equity investments. By providing patient capital and strategic guidance, family offices can support the development and scaling of digital mental health solutions.

Strategic Insights for Family Offices

- Focus on Impact Investing:

Family offices can align their financial goals with their desire to make a positive impact by investing in companies that address mental health challenges and improve access to care. - Leverage Expertise and Networks:

Family offices often have specialized knowledge and networks in healthcare, allowing them to identify high-potential investment opportunities and provide valuable insights to portfolio companies. - Emphasize Scalability:

Investing in scalable healthcare IT solutions allows family offices to achieve significant returns while addressing pressing healthcare needs.

Navigating the Healthcare IT Landscape: Strategic Insights for Family Offices

Family offices looking to invest in healthcare IT through private equity should consider the following strategies:

- Conduct Thorough Due Diligence:

Assess the financial health, market position, and growth potential of healthcare IT companies to identify the best investment opportunities. - Diversify Investments:

Spread investments across various healthcare IT subsectors to mitigate risk and capitalize on diverse growth opportunities. - Partner with Experienced Investors:

Collaborate with other family offices, private equity firms, and venture capitalists to share expertise and resources, enhancing investment outcomes.

Wrap Up

As the healthcare landscape continues to evolve, family offices that strategically invest in healthcare IT will be well-positioned to capitalize on future opportunities and make a lasting impact on the industry.