As the healthcare industry continues to embrace digital transformation, accredited investors are increasingly leveraging private equity to fund groundbreaking innovations in healthcare technology.

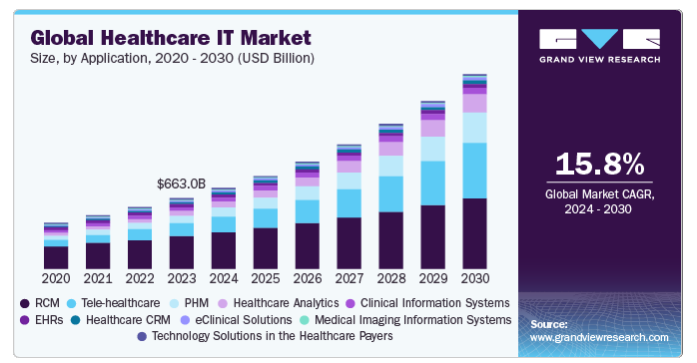

SOURCE: Grand View Research

Key Investment Trends in Healthcare Technology

Accredited investors are focusing on several key trends in healthcare technology, leveraging private equity to drive growth and innovation:

- Artificial Intelligence and Machine Learning:

AI and machine learning are at the forefront of healthcare technology investments. These technologies are being used to enhance diagnostic accuracy, predict treatment outcomes, and personalize patient care. According to Deloitte’s analysis, AI-driven innovations received the most funding in recent years, underscoring their potential to transform healthcare delivery. - Telemedicine and Remote Monitoring:

The adoption of telemedicine has surged, particularly in response to the COVID-19 pandemic. Accredited investors are backing telehealth platforms that offer remote patient monitoring and virtual consultations, providing accessible healthcare solutions to underserved populations. - Wearable Devices and Health Apps:

The integration of wearable devices and health apps is empowering consumers to take charge of their health. These technologies enable continuous monitoring of vital signs and health parameters, supporting preventive care and chronic disease management. - Digital Therapeutics and Genomics:

Investments in digital therapeutics and genomics are gaining traction as these fields offer innovative solutions for personalized medicine and targeted therapies. These technologies are expected to play a crucial role in the future of healthcare. - Cybersecurity and Data Privacy:

As healthcare organizations increasingly rely on digital solutions, cybersecurity has become a top priority. Accredited investors are funding technologies that enhance data protection and ensure the ethical use of patient information.

Mental Health Trends and Private Equity

The mental health sector is experiencing significant growth, driven by increasing awareness and demand for behavioral health services. Private equity is playing a pivotal role in this expansion, with several trends emerging:

- Expansion of Behavioral Health Facilities:

Private equity firms now own a substantial portion of behavioral health facilities, reflecting improved insurance coverage and reimbursement rates for mental health services. This trend is enabling greater access to care and operational efficiencies. - Investment in Mental Health Startups:

Accredited investors are funding mental health startups that offer innovative solutions, such as teletherapy and digital mental health platforms. Recent investments include companies like Videra Health and Resilience, which are developing scalable solutions to meet the growing demand for mental health services. - Focus on Digital Mental Health Solutions:

The integration of digital tools in mental health care, such as chatbots and virtual reality therapies, is attracting significant investment. These solutions aim to improve patient engagement and outcomes while reducing costs.

Legacy Capital Fund is proud to support mental health initiatives that positively impact the health of entire communities.

Strategic Insights for Accredited Investors: Maximizing Returns in Healthcare Technology

To maximize returns, investors should (in our opinion) focus on specific strategies that leverage the unique opportunities and challenges within this dynamic field. Drawing on insights from recent reports and industry trends, here are five strategic insights for accredited investors in healthcare technology:

1. Invest in AI-Driven Diagnostics and Treatment Solutions

Artificial intelligence (AI) and machine learning are transforming healthcare by enabling precise diagnostics and personalized treatment plans. Accredited investors should focus on companies that integrate AI into their core offerings, as these technologies have been shown to enhance patient outcomes and reduce costs. For instance, Health Catalyst’s data platform uses AI-driven analytics to improve care quality and operational efficiency, resulting in significant cost savings for healthcare organizations.

2. Prioritize Digital Therapeutics and Remote Monitoring

Digital therapeutics and remote monitoring technologies are gaining traction as essential tools for chronic disease management and preventive care. Investors should target companies that offer scalable digital health solutions, such as telehealth platforms and wearable devices. The surge in telemedicine adoption during the COVID-19 pandemic and now a newly developing viral outbreak (Mpox) underscores the potential for these technologies to expand access to care and improve patient engagement.

3. Focus on Mental Health Innovations

The mental health sector presents a significant opportunity for accredited investors, particularly in light of the growing demand for behavioral health services. Private equity is increasingly investing in mental health startups that offer innovative solutions, such as digital mental health platforms and teletherapy services. Companies like Ginger.io, which provides AI-driven mental health support, exemplify how technology can address unmet needs in mental health care.

4. Leverage Data-Driven Healthcare Platforms

Data and platform innovations are foundational to the future of healthcare. Investors should seek out companies that provide comprehensive data solutions, enabling healthcare providers to make informed decisions and optimize care delivery.

5. Emphasize Ethical and Sustainable Practices

As healthcare technology evolves, ethical considerations and sustainability are becoming increasingly important. Accredited investors should prioritize companies that adhere to ethical standards, particularly in areas like data privacy and patient consent. Ensuring that investments align with sustainable healthcare practices can enhance long-term value and mitigate risks associated with regulatory compliance.

Wrap Up

Accredited investors are at the forefront of driving innovation in healthcare technology through private equity. By focusing on key investment trends and leveraging strategic insights, they are well-positioned to capitalize on the growth potential in healthcare IT.